Following the government’s action to stop the proposed acquisition of NTUC Income’s majority shares by German insurer Allianz, Non-Constituency Member of Parliament (NCMP ) Leong Mun Wai expressed his surprise and concern.

The deal, announced on 17 July 2024, may have allowed Allianz to acquire a 51 % majority stake in the Singapore-based employer.

However, concerns about NTUC Income’s capability to preserve its social objective triggered a public protest, with notable voices speaking out against the deal.

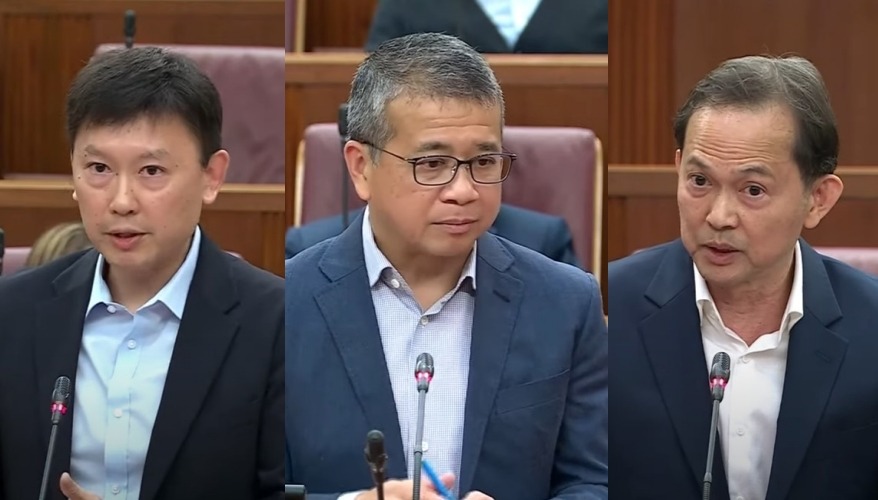

In his 14 October 2024 speech to Parliament, Edwin Tong, Singapore’s Minister for Culture, Community, and Youth, explained that the authorities found the offer” not in the open interest”.

The Ministry of Culture, Community, and Youth (MCCY ) had specific concerns regarding its impact on NTUC Income and the broader cooperative movement in Singapore.

One of MCCY’s main troubles was the capital decrease proposed in the deal, which contradicted earlier images made during NTUC Income’s 2022 corporatisation.

Minister Tong noted that NTUC Income had a surplus of over S$ 2 billion with the knowledge that it would increase its monetary viability when it transitioned from a co-op to a business entity.

The proposed money removal contradicted this goal, casting doubt on NTUC Income’s long-term capacity to accomplish its social part.

” If not for the ministerial exemption in 2023, NTUC Income’s accumulated surplus of some S$ 2 billion would have gone to the Co-operative Societies Liquidation Account ( CSLA ) to support Singapore’s co-op movement,” said Tong, adding that MCCY did not see any concrete plans to safeguard this sum for social purposes in the current deal.

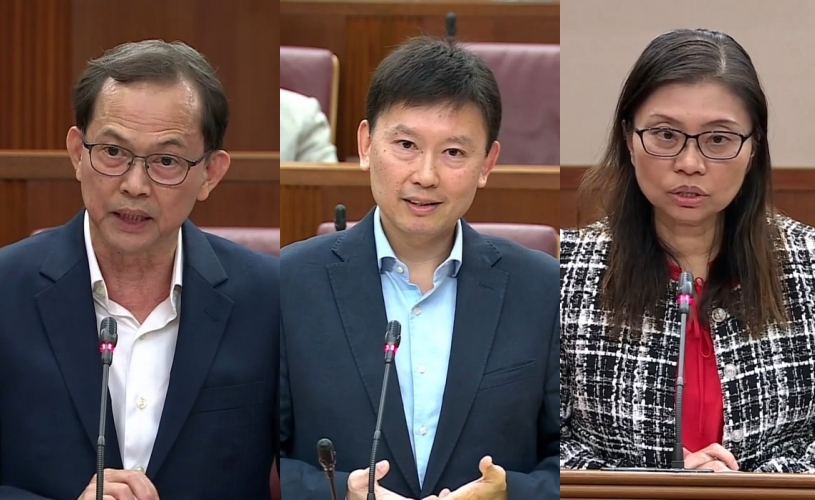

NCMP Leong expressed his surprise at the reporting of the deal’s important information, which had not been made public.

The Progress Singapore Party NCMP called for greater accountability in financial transactions, saying,” This information should be accessible to all Singaporeans”.

He added,” For decades, we believed the provided information was full, only to discover the capital recovery plan today. This is a critical requirement for any financial arrangement, and it was not made public when we discussed the offer.

Mr. Leong pressed for transparency, enquiring about who was accountable for withholding this crucial knowledge and whether the government would take steps to address the monitoring.

He stressed the importance of clarity, especially in transactions involving agencies with social operations, like NTUC Income.

The proposed capital reduction was initiated by Allianz and had yet to receive approval from MAS, according to Mr. Chee Hong Tat, Second Minister for Finance and Deputy Chairman of the Monetary Authority of Singapore ( MAS ) Board of Directors.

He noted that it is typical for regulators to review every aspect of a plan before coming to a decision.

Mr. Chee assured Parliament that all questions and concerns regarding the cash reduction had been answered openly. He referenced Minister Tong’s earlier conversation, which outlined the key factors behind the president’s concerns, especially regarding the potential effect on NTUC Income’s cultural mission.

Minister Tong reiterated that the government had been clear in its evaluation of the purchase and urged Mr. Leong to not interpret the situation incorrectly.

Government’s Reaction and Minister Tong’s Position

Minister Tong said the president’s decision to halt the deal was related to Allianz’s standing as a client and was focused on the construction of the package.

The government expressed concern about the inability to keep NTUC Income’s cultural goal alive. The MCCY remained unsure whether for commitments were supported by legally bound rules even though NTUC Enterprise had pledged to keeping this goal.

Minister Tong also revealed that after the purchase, NTUC Enterprise would have become a majority shareholder, with limited impact on NTUC Income’s potential manner, holding fewer table seats and losing its ability to assign the chairman. Together with the money extraction and lack of architectural protections, they posed a significant chance, even though these factors alone did not cause any government criticism.

Minister Tong stated that if the concerns raised were addressed, the government would continue to support the current deal, but it would be open to proposals from Allianz or other partners in the future.

The government’s position is not that NTUC Income should seek partnerships or external funding, but rather that any deal must ensure that NTUC Income’s ability to fulfill its social mission and does not harm the cooperative movement as a whole, according to Tong.

MAS’s Role and Response from Finance Ministry

During the same Parliamentary session, Tanjong Pagar GRC MP Joan Pereira questioned why the Monetary Authority of Singapore ( MAS ) had not shared Allianz’s capital extraction plan with MCCY earlier, given its significance to the Income-Allianz transaction. This raised questions about how well-organized government departments are in charge of crucial financial transactions.

Minister Chee explained that MAS had received the proposal for capital extraction in mid-July 2024 in response to Pereira’s question. At that time, MAS was primarily focused on Allianz’s financial strength and ensuring protection for NTUC Income’s policyholders. MAS did not immediately recognize the relevance of the capital reduction in relation to MCCY’s earlier decision to exempt NTUC Income during its corporatization.

Only after the 6 August 2024 Parliamentary Session did MAS find any potential repercussions for MCCY’s oversight of NTUC Income. Minister Chee added that MAS typically only shares regulatory information with other government agencies when necessary. Once the more extensive implications became apparent, MCCY made the decision to inform.

Public Outcry and Concerns

The controversy surrounding the deal largely revolved around concerns that Allianz, as a multinational corporation, would not be aligned with NTUC Income’s mission to serve the needs of lower-income Singaporeans.

The goal of NTUC Income was clear: to offer affordable insurance options, particularly for those who belong to the lower-income and labour movements.

Several prominent voices spoke out against the transaction.

Tan Kin Lian, a former NTUC Income CEO, expressed concern about the potential shift in NTUC Income’s priorities, claiming that the proposed deal could undermine its original intent.

Similarly, ambassador-at-large Tommy Koh and former Group CEO of NTUC Enterprise Tan Suee Chieh voiced their opposition.

Mr. Tan Suee Chieh went so far as to refer to the agreement as a “breach of good faith” and pleaded with the government to step in.

The key fear was that Allianz’s corporate objectives, which are driven by profit motives typical of global insurers, would lead to a reduction in NTUC Income’s commitment to affordable and accessible insurance for Singapore’s working class.

There were worries that under Allianz’s ownership, insurance premiums could increase, pricing out low-income individuals who depend on NTUC Income’s services.

In order to compete with other insurers on an equal footing with each other, NTUC Income, Singapore’s one and only insurance cooperative, was converted into Income Insurance Limited in 2022.

At the annual general meeting in 2022, shareholders were assured that NTUC Enterprise would continue to control the majority of the new business following incorporation.