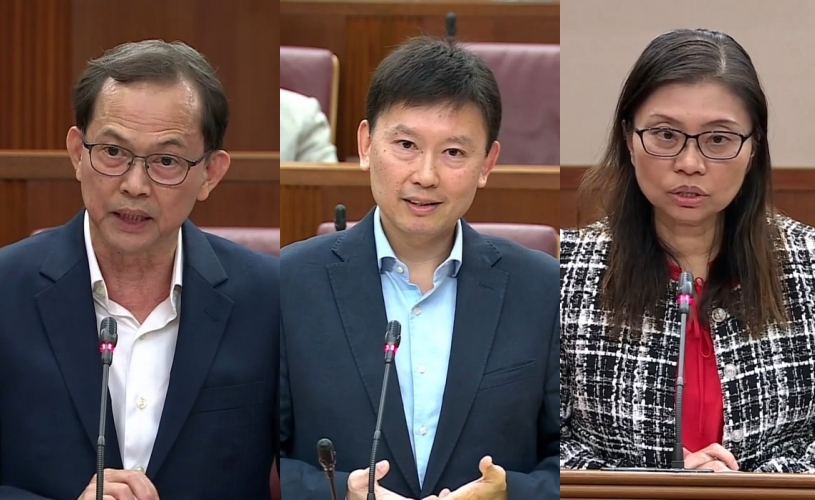

Next Minister for Finance, Mr. Chee Hong Tat, stated that wealth inequality is challenging to precisely measure because it is difficult to obtain comprehensive wealth data in various forms that are frequently difficult to value.

He noted that the Banking Act protects bank payment information in Singapore because financial success is so very smart across borders.

” Many countries and other international organizations have similar data challenges in terms of properly assessing money disparity.”

Mr. Chee argued that foreign studies, like the UBS Global Wealth Report, use presumptions that may not fully account for Singapore’s wealth inequality due to differences in technique and data limits.

Mr. Chee was responding to a problem from Yio Chu Kang SMC Member of Parliament, Mr. Yip Hon Weng, who questioned the government’s response to its efforts to combat money inequality.

His examination came in light of a July document highlighting that while Singapore’s common prosperity has risen, but has wealth disparity.

Mr. Yip specifically inquired about additional measures the government is implementing in addition to the current handouts and Central Provident Fund ( CPF ) top-ups.

He also questioned whether the Progressive Wage Model ( PPM) needs to be improved to enable lower- and middle-income workers to increase their pay increases, which could lead to a reduction in wealth.

In a letter of reply to Mr. Chee on October 14, 2024, he stated that the government is working to improve income and wealth data set to enable a more accurate assessment of injustice.

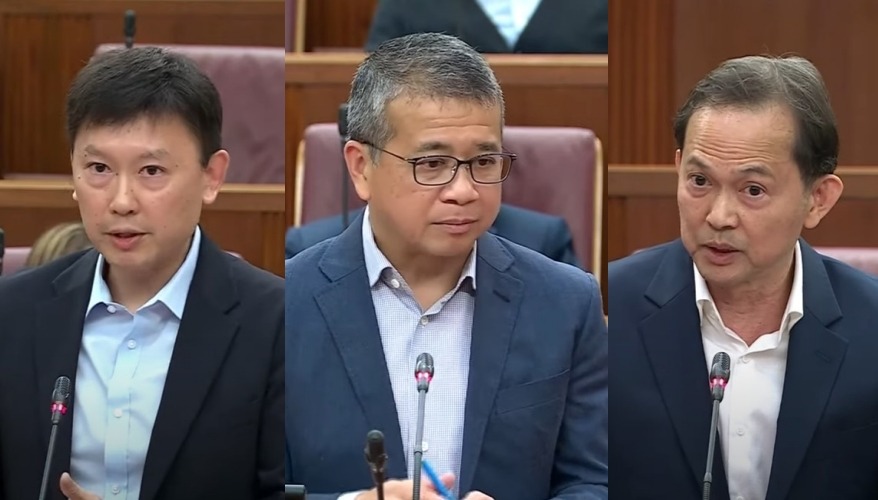

On the steps being implemented, Mr Chee highlighted some key efforts aimed at addressing money disparity. He cited the Housing and Development Board ( HDB) home ownership scheme and the CPF, both of which enable Singaporeans to accumulate significant assets over their lifetimes.

The Government provides important housing grants of up to S$ 120, 000 for lower-income Singaporeans to help with home equity.

These offers, announced at the National Day Rally 2024, are designed to create home equity more visible, complementing the discounted prices of fresh cottages.

Mr Chee more elaborated on the democratic nature of Singapore’s tax structure. Wealth fees, including mark jobs, property taxes, and the Extra Registration Fee for engine vehicles, have been made more democratic over time.

New Expenses have introduced higher residual stamp duty costs on high-value qualities, and increased property tax rates for non-owner-occupied domestic properties. The Government’s transfer schemes, which are means-tested, also factor in wealth proxies such as home ownership and property value.

In the realm of education, Mr Chee underscored the Government’s commitment to providing equitable opportunities for all Singaporeans. The education system, which is heavily subsidised, offers multiple pathways to success, regardless of socio-economic background.

On average, the Government invests more than S$ 250, 000 per child from pre-school to post-secondary education. This investment encourages the accumulation of long-term wealth for students and prepares them for careers.

For lower-wage workers, Mr Chee cited the success of the Progressive Wage Model ( PWM ) in driving wage growth. Between 2013 and 2023, real wages for workers at the 20th percentile grew by 30 %, outpacing the median worker’s 22 % increase.

The PWM, which emphasizes wage increases on skill and productivity gains, has expanded to industries like food service and waste management. The government has also increased the Local Qualifying Salary to S$ 1,600 and expanded the Workforce Income Supplement ( WIS ) program to provide additional financial support.

The Government recently introduced the ITE Progression Award in response to young workers ‘ potential for long-term employment. This initiative provides Institute of Technical Education ( ITE ) graduates with financial incentives to upskill to diploma levels, offering S$ 5, 000 in their Post-Secondary Education Accounts and a S$ 10, 000 CPF top-up upon diploma completion.

The objective is to increase graduates ‘ starting salaries and potential for higher earnings while promoting wealth accumulation through home ownership or retirement savings.

The Government will continue to look at ways to combat wealth inequality, including by keeping our social support initiatives targeted at lower and middle-income households, Mr. Chee said.

The Global Wealth Report 2024 by UBS, published in July, revealed that the number of millionaires in Singapore rose to 333, 204 in 2023, a 0.4 % increase from 332, 000 in 2022.

Total household wealth in Singapore also grew by 5.6 % in 2023, reaching over US$ 2 trillion, compared to the 4.2 % global increase in household wealth, following a 3 % contraction the previous year.