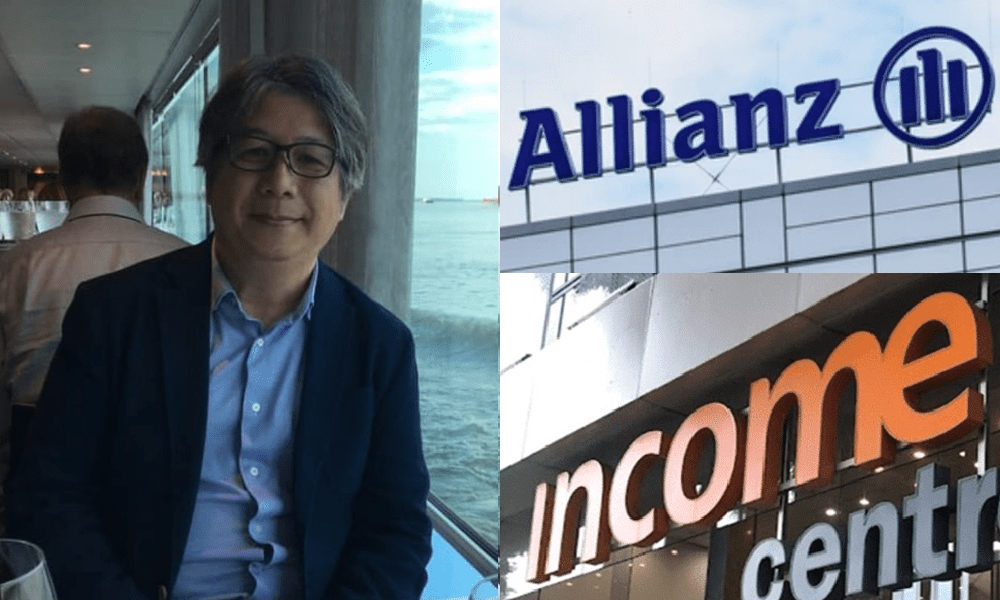

retired Taiwanese businessman Chris Kuan has been debating the contract’s terms and economic repercussions since its announcement, and the recently blocked merger of a majority interest in Income Insurance by Allianz has drawn strong criticism from him.

Kuan, who first supported the merger from a price standpoint, now questions the proposed investment reduction and NTUC Entreprise’s motivations.

The deal, announced in July 2024, would have seen German insurer Allianz acquire a 51 % stake in Income.

But, on 14 October 2024, the Singapore government intervened, citing concerns over Income’s ability to maintain its social vision and the important cash recovery proposed in the package.

In a series of extensive Twitter posts, Kuan criticised the unknown S$ 2 billion investment decline, which would have allowed shareholders, primarily NTUC, to collect funds from Income soon after the transaction. Contrary to popular belief, Kuan argued that Allianz, despite reducing its consolidation charge, was not the real success in this design.

There are numerous comments online that claim Allianz is being made a devil of a lot of money as a result of the money reduction, making it the bigger winner, according to Kuan. ” This is absolutely wrong”.

Kuan explained that under the deal’s structure, Allianz was set to pay S$ 2.2 billion for a 51 % stake in Income, whose total equity stood at S$ 3.2 billion as of its last financial statement.

After the acquisition, the$ 2 billion capital reduction would kick in, with Allianz receiving about$ 1 billion, which would reduce its total outlay to S$ 1.2 billion. But, Kuan highlighted the problem: Allianz may end up owning 51 % of a significantly smaller object, with Income’s capital base dropping from S$ 3.2 billion to only S$ 1.2 billion.

” In effect, Allianz’s total outlay is S$ 1.2 billion for a company whose total capital is now just S$ 1.2 billion, after having S$ 2 billion extracted from its capital base”, Kuan pointed out. He claimed that this made Allianz pay a sizable subscription for a much smaller employer following the acquisition. The narrative was flipped by the revelation, demonstrating that Allianz was n’t reaping the full benefits of the capital reduction.

Kuan compared NTUC’s status to Allianz’s, who had a significant gain from the deal. “NTUC gets S$ 2.2 billion from Allianz and another S$ 1 billion from the capital reduction—altogether S$ 3.2 billion”, he noted.

Kuan emphasized that NTUC actually benefited from the transaction, getting benefit from both the purchase and the capital that was also extracted. He added that this might explain why no other carriers submitted competing requests because other competitors in the sector regard NTUC’s asking price as very high.

” This is why IPO]initial public offering ] is not an option”, Kuan added. ” The European approach to NTUC is much better. It now appears that the Germans were paying an even higher premium with the publication of the S$ 2 billion investment decline.

Kuan criticized NTUC’s desire to pass the deal, and made reference to potential conflicts of interest, especially with top executives who may work for both NTUC and Income.

” You can fully understand why NTUC die die wanna do this deal … the price NTUC is getting is too high”, Kuan commented. In a time when there are stricter capital adequacy requirements for businesses and insurers, he even questioned the propriety of such a significant investment decrease.

Kuan argued that Allianz reducing its expenditures through the money extraction did not make the German firm the real winner. A significantly reduced Income, whose coming money base would be slashed, would be left to Allianz with a majority interest in it.

Kuan speculated that NTUC may have attempted to “extract as much as it can possibly get away with” as a result of the money decrease, leaving Allianz with a smaller business.

As Kuan delved deeper into the financials, he made clear that Tan Suee Chieh, the previous NTUC Income CEO, disagreed with the offer.

Tan had recently suggested that Income does leave capital-heavy coverage products, like annuities and savings products, to prevent the need to raise further capital.

Kuan emphasized the irony of the Income-Allianz agreement’s implementation of this strategy.

” The irony is that Allianz’s business plan goes along the lines of what Tan had suggested Income to do … exiting capital-heavy product lines”, Kuan said.

In his Wednesday ( 16 Oct) post, Kuan elaborated further on the mechanics of the proposed capital reduction. He explained that the insurer would likely have to exit its capital-intensive product lines, such as annuities and savings products, for Income to execute the S$ 1.85 billion reduction within the next three years.

By doing so, Income’s risk exposure would shrink, allowing it to reduce the amount of capital needed and freeing up funds to be returned to shareholders. Following the agreement, Income would become a much smaller insurer, though.

Kuan argued that NTUC and Allianz would gain from this reduction, but that they would still be left with a majority stake in a significantly smaller business.

” Allianz is left owning 51 % of a company whose capital base is reduced by more than half”, Kuan remarked. He argued that Allianz was stuck with a smaller, less capitalized company, while this deal structure was more advantageous for NTUC, allowing them to extract both the acquisition proceeds and capital reduction gains.

Addressing public misconceptions, Kuan cautioned against interpreting the government’s ruling as a win for those who had opposed the deal on ideological grounds.

Many of the arguments about Income’s social mission, he stated, were not the basis for the government’s decision.

By reading only the headlines or reading only what they want to read, Kuan wrote,” The plebs are cheering the deal that the government has blocked.”

” None of those favoured arguments formed the basis of the government’s objection, which is based almost entirely on the previously non-disclosed capital reduction”.

Kuan ultimately suggested that the agreement could be revised. He speculated that Allianz and NTUC might change the terms, possibly removing the capital reduction or transferring the funds to the Co-operative Societies Law Association ( CSLA ) instead.

” I can see a revised deal in which S$ 2 billion is extracted before the sale to Allianz, and paid to the CSLA”, Kuan wrote.

This scenario, however, would require NTUC to accept that it could no longer benefit from the capital extraction.

Kuan’s thorough analysis of the deal highlights his transition from strong criticism to initial support, particularly regarding NTUC’s exaggerated gains and the dubious capital reduction.

While the government’s intervention has blocked the deal for now, Kuan believes this may not be the final chapter, with Allianz likely to return with a revised proposal.